· Jack Young · Education · 9 min read

Unit 34 (P5): Trading and Profit Loss

Trading profit and loss account looks at all of the money that the business makes through sales. Then pays out for the expenses that have to be paid.

Interpret the contents of a trading and profit and loss account and balance sheet for a selected company (P5)

Trading and Profit and Loss

Trading profit and loss account looks at all of the money that the business makes through sales. Then pays out for the expenses that have to be paid.

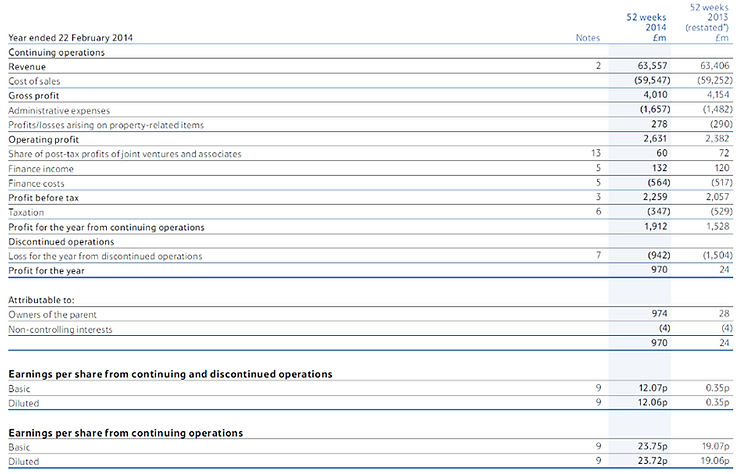

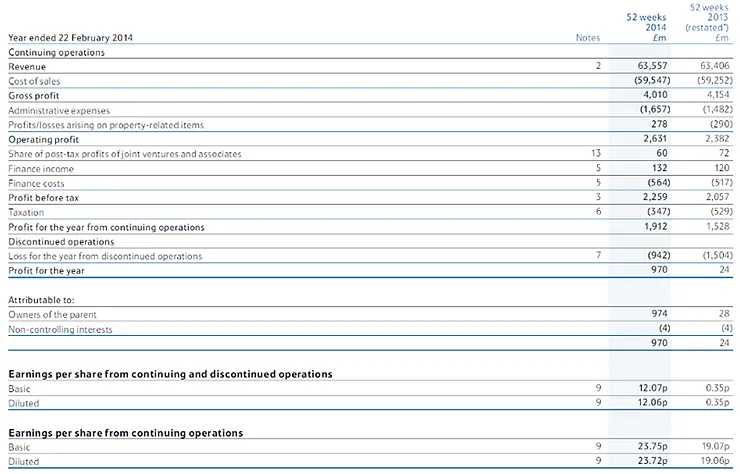

The trading profit account shows that Tesco has made a gross profit of £4,010million. This is because Tesco has a revenue totalling £63,557million and this value is taken away from the cost to buy the products which adds up to £59,547million. This shows that the business has made this much money from when they started the year and after paying out all of the money for purchasing the goods. However, the gross profit does not take into consideration of anything else that the business needs to pay for such as energy, wages and taxes.

The next section of the trading profits and loss account is the operating profit. To calculate the operating profit, you need to take the administrative expenses from the gross profit and add/subtract the profits/losses arising on property-related items. The administrative expenses are all of the staff wages, building rent, equipment, insurance etc. The administrative expenses totals £1,657million. The profits/losses arising on property-related items are the investments that Tesco makes when other business rent property owned by Tesco and the expenses of Tesco renting property from other businesses. The property-related items totals £278million. Tesco has made a profit of property-related items which is why we add it after the administrative expenses has been taken away from the gross profit as the administrative expenses are money spent on administrative items like rent. This means that the operating profit comes to a total of £2,631million. This is the money earned by Tesco before tax as the operating profit does not get taxed, we take this value away from the gross profit first before it is taxed.

Before the money is taxed, Tesco also has shares and a finance income to add as well as this money is taxed. The share of post-tax profits of joint ventures and associates are profits which Tesco invests into a business that is starting up or a business in need of funding. This money only totals a small amount of £60 million. This means that the businesses that Tesco invested into did not gain a lot of profit from. The finance income and the finance cost need to be taken away from each other which totals £432 million loss. The £60 million profit needs to be added to the £432 million loss which totals £372 million loss. Since it is a loss, it needs to be taken away from the operating profit which totals £2,259 million. This means that the finance was a loss for Tesco and they need to increase their income and cut down on the cost.

The next section of the trading profits and loss account is the net profit after everything has been paid out. For Tesco, the profit before tax is £2,259 million after all of the wages, rent and other expense have been paid. This, of course, needs to be taxed. After the taxation, this leaves Tesco with £1,912 million. I worked out that the tax to be approx. 15.361%. Finally, this then needs to be taken away from the loss for the year from discontinued operations which totals £942 million. This gives the total profit (or net profit) for Tesco in year 2014 to sum up to £970 million. This is a big improvement from 2013 profit that Tesco has made which totals a shocking £24 million. This shows that Tesco has improved in 2014.

It is important that Tesco have a net profit that they can use for the following year as they can use it to invest in more property-related items as Tesco made a good amount profit from it and if they do decide to invest in that, then they will get more profit from the next year. This would mean that they would be able to make more net profit for the following year for their business.

Trading, profit and loss accounts are important for Tesco as they can see how much they have spent/gained from what they have started with which allows them to compare to previous years and also decide what they want to do for the next year. Without the financial statements, then they would not be able to see any trends in the business and how much money they have spent/gained. This will then mean that Tesco would not be able to look at their financial position and make a business decision on improving the amount of profit they gain.

Balance Sheet

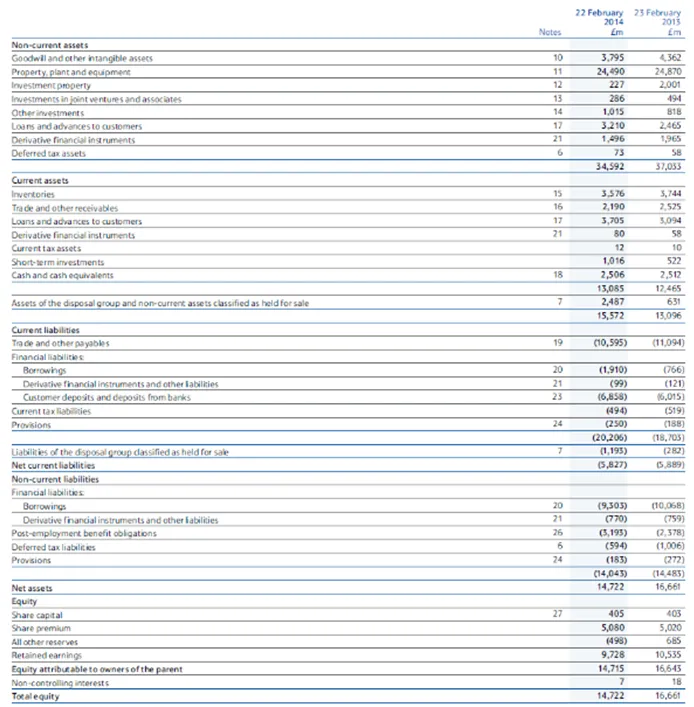

The balance sheet focuses on non-current and current assets and liabilities. This works out how much they would have to spend on what they need for the business.

Non-current assets are businesses long-term investments. Non-current assets are capitalised rather than expended, meaning that the business allocates the cost of the asset over the number of years for which the asset will be in use, instead of allocating the entire cost to the accounting year in which the asset was purchased. The total cost for non-current assets for Tesco sums up to £34,592 million. This means that Tesco has spent this much money on long-term investments like property, loans etc. This means that Tesco invested in assets that are not currently in use yet but will be in use in the next few years, hence why it is called non-current assets.

Current assets are all of the stock, debtors and deposits, money, loans and short-term investments. The total cost for current assets for Tesco sums up to £15,572 million. This can change depending on the amount of stock or the loans that they invested last year etc. This means that Tesco has spent this much money in the current year on assets like loans, tax and short-term investments etc. These are the assets that affect the current year, hence why it is called current assets.

Current liabilities are businesses debts or obligations that are due within the current year. The current liabilities include short-term debts, accounts payable, accrued liabilities and other debts. The total cost for current liabilities for Tesco sums up to £20,206 million. This is the amount of money that would be paid out. In order for Tesco to pay this much money, they would need to take the money made from the current assets in the next 12 months and subtract it from the current liabilities to get the net liabilities. The net liabilities is the money that they gain or need to pay more liabilities. The current liabilities subtract current assets would give me £4,634 million and we need to subtract the liabilities of the disposal group classified as held for sale which is £1,193 million as this is the other liabilities not included in the current liabilities. This will give the value of the net liabilities which is £5,827 million. Since it is a negative value, it is not money gained, but Tesco would still need to pay this much money to the liabilities as the current assets did not cover the cost of £20,206 million needed to be paid. This means that Tesco would need to cut down on the cost of current liabilities and not borrow a lot etc. This will make Tesco not have to pay so much and they would save money.

Non-current liabilities are businesses long-term financial obligations that are not due within the present accounting year. These non-current liabilities include long-term borrowing, bonds payable and long-term lease obligations. The total cost for current liabilities for Tesco sums up to £14,043 million. This is the sum of all the liabilities added together. There is no net non-current liabilities as the non-current liabilities does not need to be paid yet and also the current assets has already been taken out to pay for the current liabilities that need to be paid. The sum of the non-current liabilities is smaller than last years’ which means that hopefully, the current liabilities for 2015 will be less and Tesco would be spending less money on liabilities and saving money.

Finally, the net assets is the amount of money when you take away liabilities from assets, this includes both current and non-current. Tesco has already paid out all of the current assets to try and pay for the current liabilities. In this case, to get the net assets, we need to add the net current liabilities and the non-current liabilities and take this this value away from the non-current assets. This will give the value of £14,722 million. This means that next year when the non-current assets become current, then Tesco would be able to pay for the current liabilities as the net assets is a positive number. But this does not include the non-current liabilities for next year. So the £14,722 million will most likely be spent on covering the non-current liabilities for next year and so on.

The balance sheet is an important as it allows Tesco to see how well they are doing currently and are able to see whether they would be able to run the business in a year’s time or make any changes to the way they manage the business to cut down on cost to run the business for the next year. This would mean that Tesco would be able to see whether it would be worth investing in more assets or cut down on liabilities such as how much Tesco borrows money from other businesses. Therefore, this is an effective way for Tesco to look at their balance sheets to insure that they are stable enough to run efficiently as a business. On the other hand, if Tesco did not produce these financial documents then they cannot see how well they are doing. This means that Tesco cannot spot any trends in their business and will not be able to work out whether it would be worth investing into a business. Therefore, producing financial statements is important to Tesco or any business.